In today’s gig economy, many individuals work as freelancers and independent contractors, enjoying the flexibility and autonomy that comes with such arrangements. However, one challenge that often arises for these professionals is the need to create pay stubs. Pay stubs are essential for documenting income and can be required for various purposes, such as applying for loans, filing taxes, or verifying employment. In this comprehensive guide, we will explore the process of creating pay stubs for freelancers and contractors, covering important aspects and providing practical tips.

Understanding the Importance of Pay Stubs

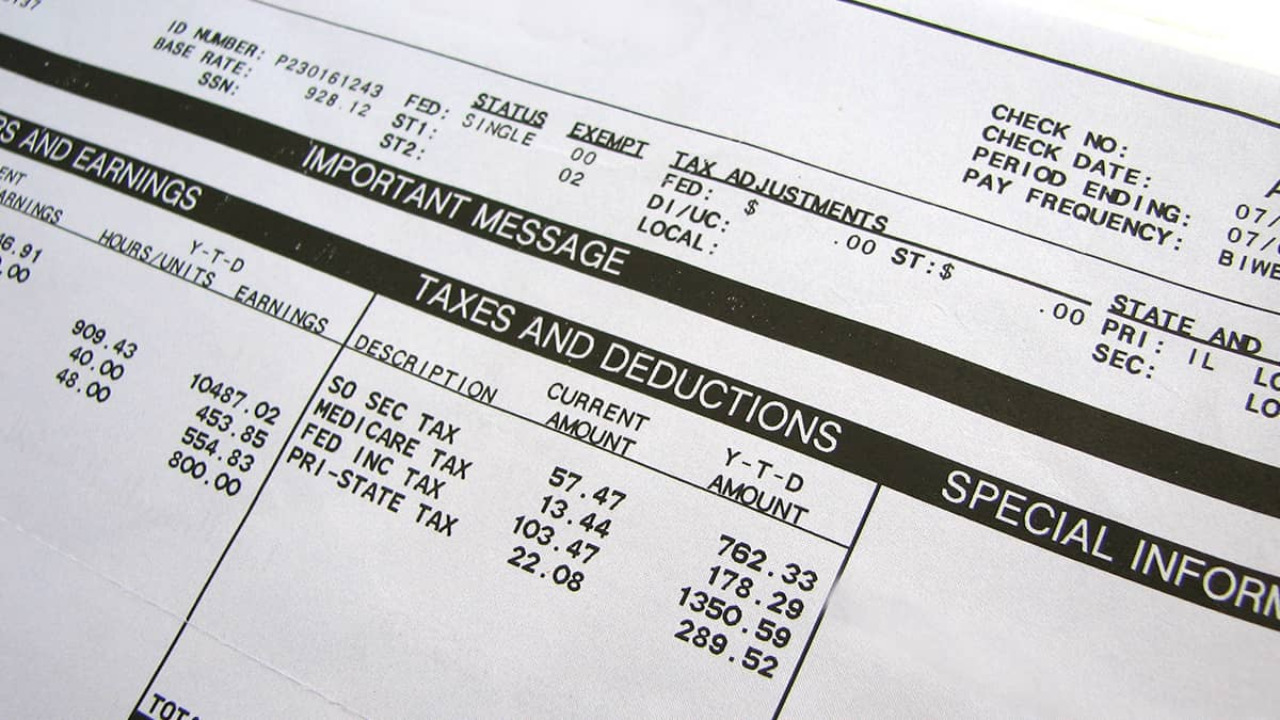

Pay stubs play a crucial role as essential financial documents for freelancers and contractors. They serve as evidence of income, validating earnings and employment status. Additionally, pay stubs are indispensable for tax-related matters, as they include information about withheld taxes and deductions. Furthermore, accurate pay stubs greatly assist in financial planning, budgeting, and expense tracking. Therefore, it is vital for freelancers and contractors to generate professional and legally compliant pay stubs. They can also generate pay stubs online.

Creating Pay Stubs: Step-by-Step Process

Gather Relevant Information:

Before diving into the pay stub creation process, gather the necessary information. This typically includes your legal name or business name, address, contact details, tax identification number (such as a Social Security Number or Employer Identification Number), and any additional details required by your jurisdiction.

Choose a Pay Stub Template:

To streamline the process, select a pay stub template that suits your needs. Numerous online platforms offer customizable templates that are easy to use. Look for templates that include sections for income, deductions, taxes, and net pay. Ensure that the template complies with local tax laws and includes any mandatory information specific to your jurisdiction.

Enter Earnings and Deductions:

Once you have a suitable template, enter the relevant information accurately. Input your earnings, specifying the payment period and hourly rate, if applicable. Include any additional income sources, such as bonuses or commissions. Likewise, record deductions, such as taxes, health insurance premiums, retirement contributions, or any other expenses you are responsible for.

Calculate Taxes:

Calculating taxes can be complex, especially for self-employed individuals. Consider consulting with a tax professional or using reputable online tax calculators to determine accurate tax withholdings. Ensure that you follow the tax regulations specific to your jurisdiction to avoid any legal issues.

Include Additional Information:

Apart from earnings, deductions, and taxes, consider including other essential details on your pay stub. These may include the employer’s contact information, pay period dates, employee identification number, and any relevant company or client logos.

Review and Save:

Before finalizing your pay stub, thoroughly review all the information entered for accuracy. Pay attention to figures, spelling, and other details to ensure your pay stub is error-free. Once you are satisfied, save the pay stub in a secure digital format for easy access and future reference.

Tools and Resources for Creating Pay Stubs

To simplify the process of creating pay stubs, various tools, and resources are available online. These tools provide user-friendly interfaces and customizable templates that can generate professional-looking pay stubs. Some popular options include:

Payroll Software:

Many payroll software solutions cater specifically to small businesses, freelancers, and contractors. These platforms offer features like automated pay stub generation, tax calculations, and even direct deposit functionality.

Online Pay Stub Generators:

Numerous websites provide pay stub generation services. These platforms typically offer customizable templates that can be filled out with your income and deduction details.

Spreadsheet Templates:

For those comfortable working with spreadsheets, using Microsoft Excel or Google Sheets templates can be a viable option. These templates often come preformatted with formulas and calculations, making it easier to input data and generate pay stubs.

In conclusion, creating pay stubs is an important aspect of managing finances for freelancers and contractors. By understanding the significance of pay stubs, following a step-by-step process, and utilizing available tools and resources, you can create professional pay stubs that comply with legal requirements.